Payment Systems & Financial Technology

Proven Testing Solutions to address growing needs of FinTech and Payment Industry

Free Consultation & White Papers

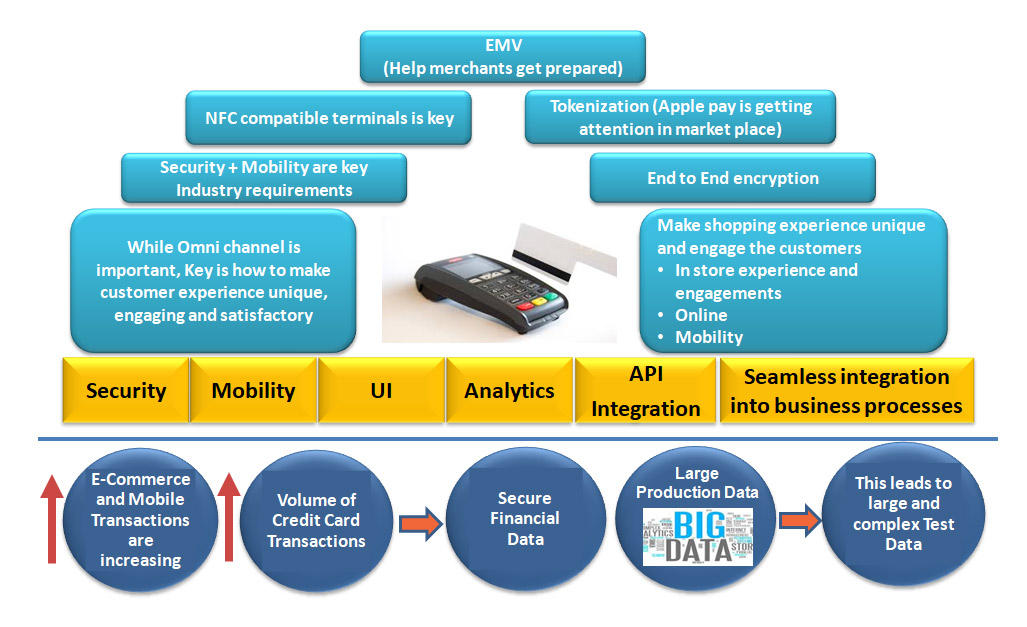

As lot of innovation and competition is going on in the payments landscape together with the prediction of blockchain taking a more prominent position, payments testing is set to become more complex, making the old ways of testing no longer effective. Businesses desirous of meeting new market demands of more efficient and faster payments have to start using FinTech and digital payments.

With our test automation framework and testing tools for mobile and web, together with our competence in vulnerability assessment and cross platform testing, we can help businesses start using FinTech and digital payments or make a smooth transition from traditional payment services to the new age digital modes.

TechArcis with its FinTech testing solutions, can help businesses make this move to digital payments seamlessly, securely and in an efficient manner.

Over the last decade, the payments landscape has evolved into an increasingly complex world (full of opportunities) where traditional payment methods are making way for FinTech and digital payments. With a growing number of customer devices and apps for payments, together with a wide variety and number of endpoints, a stricter level of regulatory scrutiny and the ‘always-on’ availability demand and expectation is set in.

Technology companies with financial domain expertise and other financial service providers have started adopting FinTech. Businesses planning to join the league or those that have already done so can take advantage of FinTech and payments testing services of TechArcis to ensure real-time payments in this cashless economy run as smoothly and securely as possible.

For quality assurance of any FinTech software or application, we test the five key areas namely:

Our technology and domain experts also offer QA and testing services for:

With our test automation framework and testing tools for mobile and web, together with our competence in vulnerability assessment and cross platform testing, we can help businesses start using FinTech and digital payments or make a smooth transition from traditional payment services to the new age digital modes.

As lot of innovation and competition is going on in the payments landscape together with the prediction of blockchain taking a more prominent position, payments testing is set to become more complex, making the old ways of testing no longer effective. Businesses desirous of meeting new market demands of more efficient and faster payments have to start using FinTech and digital payments. With our FinTech testing solutions, we at TechArcis can help businesses make this move to digital payments seamlessly, securely and in an efficient manner.

It’s all about how your customers feel about your products, solutions or the service you provide. Nobody likes a buggy product or sub-par service. Our belief is “Quality and Convenience drives Customer Success”. Our mission is embedding Quality in Software and Product development process.

We believe in creating an eco-system of industry experts, our associates, tools, technologies and clients. Good Partnerships strengthen our belief and commitment in providing value to our clients and help them succeed in the market place. We believe in inclusive growth and strive for success of our partners, associates and clients. Our focus is 360° Quality, Digital Transformation, Mobility, Agile and DevOps to enable “Continuous Quality @ Speed”.

We work with YOU with a goal to bring delight to your Customers. We are Quality experts with a passion and skill in testing, no problem is too complex and too small for us. We have a proven track record of delivering 100’s of successful QA and Testing Projects for World’s most innovative companies. We have helped our clients roll out products and software that wow their clients, build brand recognition and increase their revenue and profitability.